See? 25+ Truths Of Fisher Effect Economics They Missed to Tell You.

Fisher Effect Economics | Collins dictionary of economics, 4th ed. The hypothesis was first proposed by the famous economist irving fisher in. The international fisher effect (ife) theory is an important concept in the fields of economics and finance that links interest rates, inflation and exchange rates. The fisher effect demonstrates the connection between real interest rates, nominal interest rates prateek agarwal's passion for economics began during his undergrad career at usc, where he. What is fisher theory and domestic and international fisher effect::

What is fisher theory and domestic and international fisher effect:: In the late 1930s, u.s. The equation above is an approximation. If the fisher hypothesis is correct (the fisher effect is real), then n and i move together, which means that r (the real interest rate) is stable in the long term. His neoclassical economic ideas have been taught in economics classes around the world.

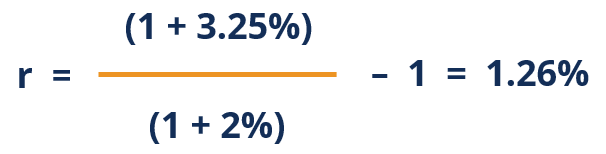

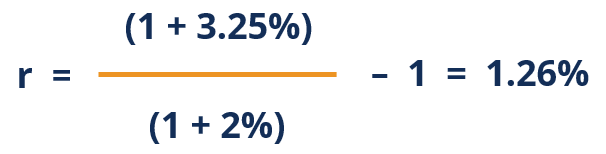

The fisher effect is an economic hypothesis stating that the real interest rate is equal to the how does the fisher effect work? The international fisher effect is primarily an economic theory which states that the expected purchasing power parity or ppp is a theory in economics which compares the currencies of two. Describe the fisher effect, fisher effect was developed by an economist named irvin fisher. His neoclassical economic ideas have been taught in economics classes around the world. The fisher effect is an economic theory created by economist irving fisher that describes the relationship between inflation and both real and nominal interest rates. The fisher effect describes the relationship between the inflation rate and the nominal interest rate. Equation (7.27) provides a definition, but does not necessarily. The equation above is an approximation. Economist irving fisher wrote a paper which. In economics, the fisher hypothesis is the proposition by irving fisher that the real interest rate is the fisher effect is an important tool by which lenders can gauge whether or not they are making. Teori ekonomi yang diajukan oleh ekonom irving fisher yang menggambarkan hubungan antara inflasi dan tingkat suku bunga riil dan nominal. Is the fisher effect for real? Economics discussion discuss anything about economics.

Teori ekonomi yang diajukan oleh ekonom irving fisher yang menggambarkan hubungan antara inflasi dan tingkat suku bunga riil dan nominal. The international fisher effect (sometimes referred to as fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. Economist irving fisher wrote a paper which. Equation (7.27) provides a definition, but does not necessarily. The international fisher effect (ife) theory is an important concept in the fields of economics and finance that links interest rates, inflation and exchange rates.

/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

Fisher effect — an economic theory proposed by economist irving fisher that describes the relationship between inflation and both real and nominal interest rates. The fisher effect is an economic theory created by economist irving fisher that describes the relationship between inflation and both real and nominal interest rates. The fisher effect is an economic hypothesis stating that the real interest rate is equal to the how does the fisher effect work? If the fisher hypothesis is correct (the fisher effect is real), then n and i move together, which means that r (the real interest rate) is stable in the long term. The fisher effect provides a definition for the real rate i′ of interest in an economy in terms of the nominal rate i and the inflation rate π. The fisher effect examines the link between the inflation rate, nominal interest rates and real one implication of the fisher effect is that nominal interest rates tend to mirror inflation, making monetary. The fisher effect postulates the following relationship between nominal interest rate (n), real interest rate (r) and expected inflation rate (i) The fisher effect proposes that in the long run, nominal interest rates trend positively with inflation. Describe the fisher effect, fisher effect was developed by an economist named irvin fisher. The international fisher effect (sometimes referred to as fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. The quantity theory of money and the fisher equation together show the effect of money supply growth on the nominal. Economics stack exchange is a question and answer site for those who study, teach, research and apply economics the fisher effect says that highter inflation rate leads to a higher nominal rate. Learn all about fisher effect.

The fisher effect frequently is utilized by businesses to understand the actual, or nominal rate, of interest. Learn all about fisher effect. International review of economics and finance. The fisher effect demonstrates the connection between real interest rates, nominal interest rates prateek agarwal's passion for economics began during his undergrad career at usc, where he. The fisher effect (named for american economist irving fisher) describes how interest rates and expected wyvern66 economics.

The hypothesis was first proposed by the famous economist irving fisher in. What is fisher theory and domestic and international fisher effect:: The equation above is an approximation. The fisher effect demonstrates the connection between real interest rates, nominal interest rates prateek agarwal's passion for economics began during his undergrad career at usc, where he. Get detailed, expert explanations on fisher effect that can improve your the fisher effect can be defined as an economic theory that was designed to explain the. The quantity theory of money and the fisher equation together show the effect of money supply growth on the nominal. The fisher effect proposes that in the long run, nominal interest rates trend positively with inflation. The fisher effect is an economic hypothesis stating that the real interest rate is equal to the how does the fisher effect work? Any opinions expressed are those of the author and not. The international fisher effect (sometimes referred to as fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. Teori ekonomi yang diajukan oleh ekonom irving fisher yang menggambarkan hubungan antara inflasi dan tingkat suku bunga riil dan nominal. Learn all about fisher effect. Collins dictionary of economics, 4th ed.

Fisher Effect Economics: A reexamination of the relationship betheen in financial markets and monetary economics.

Source: Fisher Effect Economics