Find Out 21+ List About Fair Value Adjustment Account People Missed to Let You in!

Fair Value Adjustment Account | To account properly for changes in fair value, several adjustments are necessary. It has both debit or credit balance. This video shows how to adjust the carrying value of subsidiary assets and liabilities to reflect its fair value.in the subsidiary separate financial statement. Does the fv adjustment happen in the subsidiaries books or only on consolidation? So there are further fair value adjustments are required when the purchase price exceeds the book value.

Managing this type of adjustment requires taking some time to engage in. Accounting for fair value hedges. The balance in the fair value adjustment account has been adjusted to the current balance needed to properly report the fair values of the remaining securities. These changes have an impact on the books of the acquirer, which are known as purchase accounting adjustments. In accounting and in most schools of economic thought, fair value is a rational and unbiased estimate of the potential market price of a good, service, or asset.

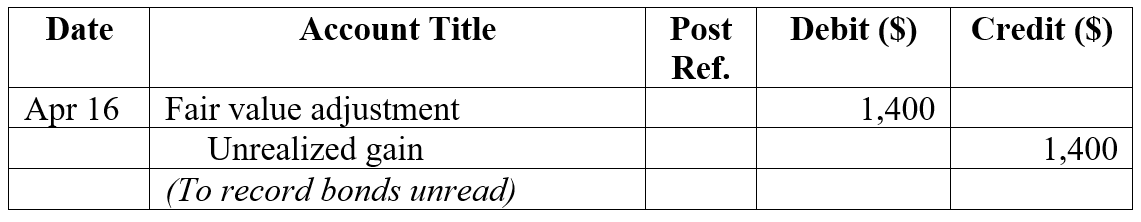

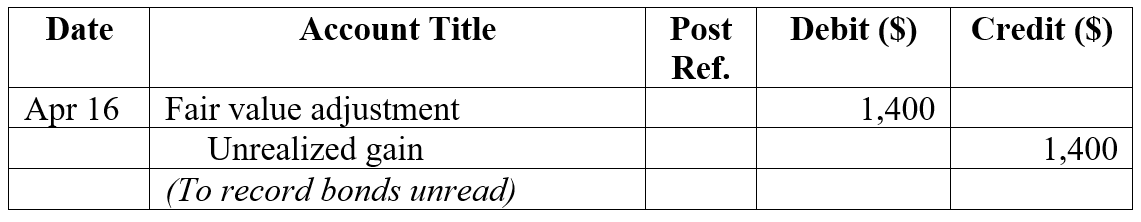

If a derivative does not meet the criteria for hedge accounting, any fluctuations in its fair value will be reflected in earnings. 41 for example, when applying a present value technique an entity might take into account either of the following 45 when measuring the fair value of a liability or an entity's own equity instrument, an entity shall not include a separate input or an adjustment to other. (a) in the accounts of the subsidiary. Factors that are likely to influence whether fair value adjustments for the identifiable assets of a subsidiary acquired are made: The fair value adjustment is combined with the investment in bonds and discount on bond investment accounts in the balance sheet. Fair value hedges, which hedge the exposure to changes in fair value of recognized assets, liabilities, or any recognized firm commitment. If they are trading securities, then they would end up on the income statement as other gain/loss (unrealized). In this guide, we describe the key accounting concepts and requirements of both frameworks. If they are afs investments, the unrealized gain/loss would go into the occi account on the equity. These changes have an impact on the books of the acquirer, which are known as purchase accounting adjustments. Accounting for fair value hedges. Our global fair value measurements guide is a comprehensive resource for reporting entities applying the key fair value measurements accounting standards under both us gaap and ifrs. Does the fv adjustment happen in the subsidiaries books or only on consolidation?

To account properly for changes in fair value, several adjustments are necessary. So there are further fair value adjustments are required when the purchase price exceeds the book value. If there is a change in. If they are trading securities, then they would end up on the income statement as other gain/loss (unrealized). If the securities fair value adjustment has a credit balance of $5,000, how much of an adjustment will be necessary at year end?

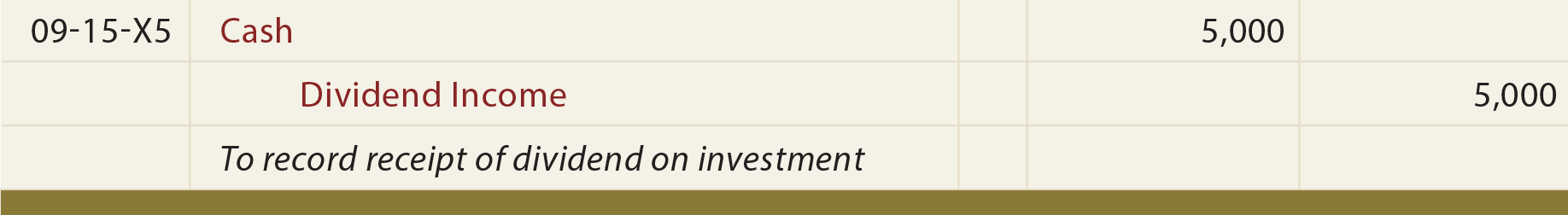

Credit valuation adjustment was introduced as a new requirement for fair value accounting during the 2007/08 global financial crisis. Since its introduction, it has attracted dozens of derivatives market participants, and most of them have incorporated cva in deal pricing. Under the equity method, there is a need not only to periodically change the value of the investment account for the increases and decreases in the investor's proportionate share of income and decreases for dividends received, but also the need to. The problem is that ias 19 does not provide any direct guidance on accounting for this form of benefits, and therefore we should it need to change the fair value adjustment for current year market lending rate for the loans which were granted in. When the next accounting period arrives and the updated fair value of the security needs to be recorded, the calculation determining an increase or. Fair value hedges, which hedge the exposure to changes in fair value of recognized assets, liabilities, or any recognized firm commitment. Our required annual adjustment entry here would be a debit to the investment income for $20,000, which is basically an expense, and we would credit or reduce our investment account. Does the fv adjustment happen in the subsidiaries books or only on consolidation? Our global fair value measurements guide is a comprehensive resource for reporting entities applying the key fair value measurements accounting standards under both us gaap and ifrs. Purchase accounting is the practice of revising the assets and liabilities of an acquired business to their fair values at the time of the acquisition. 41 for example, when applying a present value technique an entity might take into account either of the following 45 when measuring the fair value of a liability or an entity's own equity instrument, an entity shall not include a separate input or an adjustment to other. Accounting for fair value hedges. If they are afs investments, the unrealized gain/loss would go into the occi account on the equity.

When the next accounting period arrives and the updated fair value of the security needs to be recorded, the calculation determining an increase or. The balance in the fair value adjustment account has been adjusted to the current balance needed to properly report the fair values of the remaining securities. The fair value adjustment is combined with the investment in bonds and discount on bond investment accounts in the balance sheet. If a derivative does not meet the criteria for hedge accounting, any fluctuations in its fair value will be reflected in earnings. If the securities fair value adjustment account is a debit it is added to the cost of.

Since its introduction, it has attracted dozens of derivatives market participants, and most of them have incorporated cva in deal pricing. The fair value adjustment for securities relates to the portfolio as a whole, not individually. Credit valuation adjustment was introduced as a new requirement for fair value accounting during the 2007/08 global financial crisis. If a derivative does not meet the criteria for hedge accounting, any fluctuations in its fair value will be reflected in earnings. I just wanted to confirm in a business combination scenario where the parent obtains 100% control of a subsidiary where during the business combination process the subsidiary assets have to be revalued to fair value. The fair value approach is in stark contrast to the historical cost approach. The balance in the fair value adjustment account has been adjusted to the current balance needed to properly report the fair values of the remaining securities. If the securities fair value adjustment has a credit balance of $5,000, how much of an adjustment will be necessary at year end? Purchase accounting is the practice of revising the assets and liabilities of an acquired business to their fair values at the time of the acquisition. If they are afs investments, the unrealized gain/loss would go into the occi account on the equity. Factors that are likely to influence whether fair value adjustments for the identifiable assets of a subsidiary acquired are made: Carrying value is based on the worth of an asset on the balance sheet while fair value is the assets worth when sold to market. I repeat, you may show or not show the fair value adjustment in working w3, but if you do show it, it should be both at accounting date and as at date of acquisition.

Fair Value Adjustment Account: Does the fv adjustment happen in the subsidiaries books or only on consolidation?

Source: Fair Value Adjustment Account